UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the fiscal year ended

or

For the transition period from [____] to [____]

Commission file number

(Exact name of registrant as specified in its charter) |

| ||

State or other jurisdiction of incorporation or organization |

| (I.R.S. Employer Identification No.) |

|

|

|

| ||

(Address of principal executive offices) |

| (Zip Code) |

Registrant’s Telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class |

| Name of Each Exchange On Which Registered |

N/A |

| N/A |

Securities registered pursuant to Section 12(g) of the Act:

Title of Class | Trading Symbol(s) | Name of each exchange on which registered |

Warrants | LEXXW | Nasdaq |

Indicate by check mark if the registered is a well-known seasonal issuer, as defined in Rule 405 the Securities Act Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act Yes ☐

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the last 90 days.

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-K (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☒ | Smaller reporting company | ||

|

| Emerging growth company |

If an emerging growth company, indicate by a check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of February 28, 2021, the last day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the common stock held by non-affiliates of the registrant was approximately $

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of the latest practicable date.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

| Page 2 of 90 |

| Table of Contents |

Cautionary Note Regarding Forward-Looking Statements

This annual report contains forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Any statements contained herein that are not statements of historical fact may be forward-looking statements relating to future events or our future financial performance and are based on our present beliefs and assumptions as well as the information currently available to us. In some cases, you can identify forward-looking statements by terminology such as "may", “will”, "should", “could”, “targets”, “goal”, "expects", "plans", "anticipates", "believes", "estimates", "predicts", "potential" or "continue" or the negative of these terms or other comparable terminology.

These statements contain predictions and involve known and unknown risks, including the risks in the section entitled "Risk Factors" set forth in Item 1(A) in this report on Form 10-K, uncertainties and other factors that may cause our or our industry's levels of activity, performance, achievements, or actual results to be materially different from any future levels of activity, performance, achievements, or results expressed or implied by these forward-looking statements. Although we contend that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee levels of activity, performance, achievements, or future result.

Forward-looking statements in this report include statements about, among other things: the status, progress and results of our research programs; our ability to obtain regulatory approvals for, and the level of market opportunity for, our product candidates; our business plans, strategies and objectives, including plans to pursue collaboration, licensing or other similar arrangements or transactions; our expectations regarding our liquidity and performance, including our expense levels, sources of capital and ability to maintain our operations as a going concern; the competitive landscape of our industry; and general market, economic and political conditions

We caution you not to place undue reliance on any forward-looking statements as they speak only as of the date on which such statements were made, and we do not assume any obligation to update any forward-looking statement or to reflect the occurrence of an unanticipated event. New factors may emerge and it is not possible to predict all factors that may affect our business and prospects. Further, management cannot assess the impact of each factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Solely for convenience, tradenames and trademarks referred to in this Annual Report on Form 10-K appear without the ® or TM symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights to these tradenames or trademarks, as applicable. All tradenames, trademarks, and service marks included or incorporated by reference in this Annual Report on Form 10-K are the property of Lexaria Bioscience Corp.

As used in this report, the terms "Lexaria" "we", "us", "our" and "Company" mean Lexaria Bioscience Corp. and/or our subsidiaries, unless otherwise indicated.

| Page 3 of 90 |

| Table of Contents |

PART 1

Item 1. Business

General and Historical Overview of Our Business

Lexaria is a biotechnology company seeking to enhance the bioavailability of a broad variety of active pharmaceutical ingredients (“APIs”) with its DehydraTECHTM drug delivery technology. DehydraTECH combines lipophilic APIs with specific fatty acid and carrier compounds thereby improving the way APIs enter the bloodstream while increasing the effectiveness of fat-soluble active molecules allowing lowering overall dosing and promoting healthier oral ingestion methods. DehydraTECH can be used with a wide variety of APIs encompassing fat-soluble vitamins, non-steroidal anti-inflammatory drugs (“NSAIDs”) pain medications, hormones, phosphodiesterase inhibitors, antivirals, nicotine and its analogs, and all cannabinoids including tetrahydrocannabinol (“THC”) for a variety of therapeutic indications, including hypertension, SARS-CoV-2/COVID-19 and HIV/AIDS. The Company’s technology applies to a host of different ingestible or topically administered product formats including foods, beverages, oral suspensions, tablets, capsules, creams, lotions, and skin patches.

Lexaria began filing patents for DehydraTECH in 2014 with two initial US provisional patent application filings by the original inventors Poppy’s Teas LLC, which Lexaria acquired by way of exclusive, worldwide license rights and controlling interest in the founding company. We have since increased the number of patent applications to approximately 60 with 23 patents granted worldwide to date. In addition to the US patent filings, the Company has also pursued international patent protection through filings under the Patent Cooperation Treaty, followed by national filings in over 40 jurisdictions of highest commercial potential thereunder. Our patent family includes intellectual property addressing the manufacturing and processing methods used to combine the long chain fatty acids with active pharmaceutical ingredients.

Lexaria’s patent applications developed from its Research and Development programs (“R&D”) currently include fat-soluble versions of vitamins, NSAIDs, nicotine, cannabinoids, hormones, phosphodiesterase inhibitors, and antivirals. 2018 animal studies demonstrated a propensity for DehydraTECH technology to elevate the quantity of drug delivered across the blood-brain-barrier. This expanded our patent applications and opened possibilities for improved delivery of certain central nervous system-targeted drugs that require additional R&D.

In a human clinical study performed in 2018 and published in 2019 in a peer reviewed medical journal, Advances in Therapy titled “Examination of a New Delivery Approach for Oral Cannabidiol in Healthy Subjects: A Randomized, Double-Blinded, Placebo-Controlled Pharmacokinetics Study” available on the PubMed.gov website with the identification of PMID: 31512143, Lexaria demonstrated that its technology delivered higher volumes of cannabidiol into the human circulatory system and did so more quickly than a concentration-matched positive control. This same study also demonstrated a statistically significant reduction in human blood pressure from the DehydraTECH processed cannabidiol, versus no statistical reduction in human blood pressure from the positive control.

We operate a Health Canada-licensed laboratory in Canada to conduct basic research and formulation operations, and typically outsource virtually all analytical work to independent third-party laboratories located in Canada, the USA, and Europe. Such third-party evaluation provides independent confirmation of the effects of our technology and processes.

| Page 4 of 90 |

| Table of Contents |

Lexaria’s formulation and process-oriented operations are primarily conducted in its own laboratory and validated through third-party testing, in preparation for partnering with industry leaders for adoption into their consumer products and/or drugs. Other than for R&D purposes, Lexaria does not produce, manufacture, market or distribute drugs.

Although we have experimented with consumer product development in the past, those activities occupy a declining amount of our corporate time. We first began selling trial amounts of ViPova branded black tea fortified with hemp oil and utilizing our technology, in January 2015 and added additional flavours over time.

We also began offering our first coffee and hot chocolate also fortified with full spectrum hemp oil, and also under the ViPova brand. Beginning in January 2021 we discontinued sales of consumer products, but offering a variety of self-made beverages to consumers helped us to establish the ViPova brand and helped us to develop final consumer product formulations and understand consumer needs

Generating meaningful revenue from consumer product sales was challenging and we were unable to achieve widespread retail distribution. We continue to be open to the possibility of generating sales from international markets, in those locations where hemp oil fortified foods are permissible by law.

ViPova branded products are owned by our wholly owned PoViva Corp. subsidiary. Lexaria Energy, TurboCBD and ChrgD+ branded products are owned 100% by Lexaria Bioscience Corp.

Through our product development we have communicated to the industry the versatility of our technology in specific CPG formats and we believe this strategy has been successful in assisting us in technology licensing discussions with potential new clients. We believe the range of products available and under development are sufficient to prepare for revenue growth and potentially profitable long-term operations if we are able to generate sufficient business clientele demand.

Our business strategy contains an element that we believe will be more impactful to future corporate growth that involves the further development and out-licensing of our intellectual property of molecule delivery that enhances bioactivity or absorption. We have no plans to offer for sale any products containing THC in quantities higher than 0.3%. We have discontinued all direct business activities related to non-FDA-approved uses of THC, including our former business practice of licensing our technology to businesses that were legally state-licensed to offer THC products. We also plan to license our technology to other companies for the delivery of molecules other than THC or cannabinoids, such as nicotine which we have licensed to Altria Ventures Inc., an indirect wholly owned subsidiary of Altria Group, Inc. Our October 31, 2017, announcement of the USPTO Notice of Allowance for our first patent granted and the subsequent granted patents of our technology in the US and in many other countries around the world related to new molecule groups, along with our ongoing patent filing and grants, may enhance our ability to successfully pursue our licensing initiatives during fiscal 2022.

We continue to communicate the benefits of our technology to potential licensing partners; i.e. with higher absorption levels a manufacturer could perhaps infuse smaller amounts of active molecules into a product, potentially reducing their manufacturing input costs; to provide higher bioavailability with the dosing limits being imposed or contemplated in many jurisdictions; to infuse beverages while masking the flavor and smell of the active molecules; and to reduce delivery times to the bloodstream. We believe these to be meaningful competitive advantages that may lead to the potential to generate licensing revenue, and will pursue these opportunities within the cannabinoids, nicotine, and other bioactive molecular markets both within the USA and also internationally, in those locations where they are legal and regulated by government.

Subject to budgetary availability, we also plan to conduct additional in vitro and in vivo studies testing the absorption of many API’s – CBD, NSAIDs, vitamins, PDE5 inhibitors, antiviral drugs, nicotine, and others– to substantiate the effectiveness of our technology. More than simply satisfying scientific curiosity, successful tests could lead to increased awareness and acceptance of our technology as a meaningful method by which to deliver some or all of the named molecules more effectively than their current delivery methods. Therefore, absorption tests could become an important element leading towards higher rates of acceptance of our technology licensing initiatives.

| Page 5 of 90 |

| Table of Contents |

We will pursue technology licensing opportunities as a method of generating highly profitable revenue streams over long periods of time. In addition, while nine of our US patents and eight of our Australian patents have been granted to date, we now have received granted patents in the European Union, Japan, India and Mexico, and have multiple other applications filed in the US and around the world. It is not possible to forecast with certainty when, or if, our remaining patents pending will become granted patents. But if our remaining patent applications do become granted patents, our ability to generate meaningful license revenue from our intellectual property may increase from multiple jurisdictions outside of the US.

We will continue to pursue our remaining patents pending as vigorously as we are able, since the successful granting of more of those applications could lead to material increases in shareholder value. We are pursuing patent protection in more than 40 countries around the world.

Available Information

The address of our principal executive office and research laboratory is #100–740 McCurdy Road, Kelowna, British Columbia, Canada V1X 2P7.

Our common stock is quoted on the Nasdaq under the symbol “LEXX”. We file annual, quarterly, and current reports, proxy statements and other information with the U.S. Securities Exchange Commission (the “SEC”). These filings are available to the public on the Internet at the SEC’s website at http://www.sec.gov.

Our corporate website is located at www.lexariabioscience.com (this website address is not intended to function as a hyperlink and the information contained on our website is not intended to be a part of this Report). We make available free of charge on https://www.lexariabioscience.com/investors/regulatory-filings/ our annual, quarterly, and current reports, and amendments to those reports if any, as soon as reasonably practical after we electronically file such material with, or furnish it to, the SEC. We may from time to time provide important disclosures to investors by posting them in the Investor Relations section of our website.

We maintain our registered agent's office and our U.S. business office at Nevada Agency and Transfer Company, 50 West Liberty, Suite 880, Reno, Nevada 89501. Our telephone number is (755) 322-0626.

Lexaria Bioscience Corp. is a British Columbia based reporting issuer in Canada and as such, we are required to file certain information and documents at www.sedar.com.

Our Current Business

Our business plan is currently focused on the development of strategic partnerships with licensees for our patented DehydraTECH technology in exchange for up front and/or staged licensing fees and/or royalty payments over time.

We continue to investigate national and international opportunities to investigate expansions and additions to our intellectual property portfolio. Patents have been filed specifically for the use of DehydraTECH with cannabinoids for the treatment of heart disease.

We plan to perform additional human clinical investigations in late calendar 2021 and throughout 2022 related to enhanced DehydraTECH formulations of cannabidiol in pre- and mildly hypertensive middle-aged subjects to gather additional information on blood pressure reduction potential. Lexaria also plans to conduct during fiscal 2022, evaluations of DehydraTECH’s ability to improve the oral delivery characteristics and pharmacological performance of certain other APIs. We will continue to seek beneficial acquisitions of intellectual property if and when we believe it is advisable to do so.

| Page 6 of 90 |

| Table of Contents |

Our current patent portfolio includes patent family applications or grants pertaining to Lexaria’s method of improving bioavailability and taste, and the use of DehydraTECH as a delivery platform for a wide variety of Active Pharmaceutical Ingredients (“APIs”) encompassing all cannabinoids including tetrahydrocannabinol (“THC”); fat soluble vitamins; NSAIDs pain medications; and nicotine and its analogs.

Lexaria hopes to reduce common but less healthy administration methods, such as smoking cigarettes as a delivery method for nicotine, by way of enabling development of safe and effective oral nicotine dosage forms through licensing arrangements with major tobacco companies, as it demonstrates the benefits of DehydraTECH for public health. The Company is aggressively pursuing patent protection in jurisdictions around the world. The Company currently has more than 50 patent applications pending worldwide, with 23 patents granted to date. Due to the complexity of pursuing patent protection, the quantity of patent applications will vary continuously as each application advances or stalls. Lexaria is also filing new patent applications for new discoveries that arise from the Company’s R&D programs and, due to the inherent unpredictability of scientific discovery, it is not possible to predict if or how often such new applications might be filed.

During the past fiscal year, the Company experienced the following significant corporate developments:

During the past fiscal year, the Company was granted an aggregate of four new patents in the following jurisdictions, Europe, India and Japan.

On December 9, 2020, CanPharm completed a disposition to Hill Street Beverage Company Inc. (“Hill Street”) of its use and licensing rights to use its DehydraTECH technology specifically in association with non-pharmaceutical products containing cannabis molecules that contain 0.3% or greater THC.

On January 11, 2021, Lexaria effected a reverse stock split that was conducted on a 1-for-30 basis on the Company’s issued share capital and on any outstanding warrants and options, whereby the exercise prices of such outstanding convertible securities were adjusted accordingly.

On January 12, 2021, Lexaria became a Nasdaq listed company and announced the pricing of a public offer of 1,828,571 units, with each unit comprising one share of common stock and one warrant to purchase one share of common stock at $5.25 per unit. The warrants issued pursuant to this public offering were listed on the Nasdaq under the symbol LEXXW and have an exercise price of $6.58 per share. They are immediately exercisable, and expire five years from issuance date. The underwriter was granted 30-day option to purchase up to an additional 274,285 shares of common stock and/or warrants to purchase up to the same amount of common stock, which option was exercised in full by H.C. Wainwright & Co. who acted as sole book-running manager for the offer. Gross proceeds of $11.04 million were ultimately received from the offering and Lexaria also issued five-year warrants to H.C. Wainwright & Co. entitling them to purchase up to 166,781 shares of common stock with an exercise price of $6.58 per share. Pursuant to certain tail rights held by Bradley Woods & Co. Lexaria paid Bradley Woods $316,999.62 and issued Bradley Woods five-year warrants to purchase 60,385 shares of common stock at an exercise price of $6.58 per share.

On January 14, 2021, Mr. Al Reese, Jr., was appointed to Lexaria’s board of directors. With the appointment of Mr. Reese Jr. Lexaria established a fully independent audit and finance committee and comply with the financial expert requirements of the Nasdaq.

On March 24, 2021, Lexaria announced results from a shelf-stability study. DehydraTECH CBD beverages demonstrated 93.4% of target CBD potency a year after production. The beverages also exhibited zero microbial growth over the period. Furthermore, the samples had intra-beverage variance less than 1% in CBD potency across various fractions (top, middle, and bottom) without mixing or agitation, indicating a very stable emulsion.

| Page 7 of 90 |

| Table of Contents |

On April 15, 2021, Lexaria announced the appointment of Gregory Downey as Chief Financial Officer, to replace outgoing Allan Spissinger whose contract ended on May 31, 2021.

During the spring of 2021, Lexaria commenced its human clinical study HYPER-H21-1 of DehydraTECH CBD, which is intended to validate DehydraTECH CBD’s effect on hypertension, and is a randomized, double-blind, controlled study expected to enroll 24 subjects with symptoms of either pre-hypertension or mild hypertension. A single 300 mg dose of DehydraTECH 2.0 CBD formulation will be compared against a non-DehydraTECH control of matched concentration. Time series blood pressure and heart rate analyses are primary objectives of the study. Secondary objectives include pharmacokinetic speed and rate of absorption of CBD and main metabolites as well as assessment of inflammatory markers of cardiovascular disease and nitric oxide biomarkers.

On July 5, 2021, the Company announced that it would, effective on market close July 7, 2021, voluntarily delist from the Canadian Securities Exchange (“CSE”) since an overwhelming majority of trading has moved to the Nasdaq resulting in saving management time, effort, and fees.

On June 7, 2021, Lexaria provided an update on HYPER-H21-1 progress, stating that 24 volunteers, ranging in age between 45 to 65, were dosed and the treatment was well tolerated with no serious adverse events or side effects observed or reported. The early results of this study were disclosed in July 2021 noting a difference between the DehydraTECH-CBD formulation and the control arm at the 20-minute mark was statistically significant at the 2.5% level.

Lexaria commenced a subsequent human trial study, designated as HYPER-H21-2, and completed its patient dosing in late July 2021. Initial results from the trial were disclosed subsequent to the year end. HYPER-H21-2 evaluated 16 volunteers who were pre or mildly hypertensive and received three separate doses of 150mg DehydraTECH 2.0 CBD versus placebo. HYPER-H21-2 concentrated on monitoring blood pressure reduction continuously over 24 hours and studying central arterial stiffness, physical activity and sleep quality.

The Company experienced the following significant corporate developments subsequent to August 31, 2021

Subsequent to the August 31, 2021 fiscal year, Lexaria was granted an additional two patents, one in Japan and our first in Mexico.

On September 7, 2021, Lexaria announced partial results from its human clinical study HYPER-H21-2 which evaluated DehydraTECH processed CBD in a 24-hour study of volunteers with mild to moderate hypertension. At selected times during the 24-hour study, volunteers with mild to moderate hypertension averaged as much as a 20 mmHg (i.e., 23%) decrease in blood pressure relative to placebo and over the 24-hour ambulatory monitoring period, volunteers averaged a significant reduction of 7.0% (p < 0.001) in systolic pressure with DehydraTECH-CBD relative to placebo.

On September 8, 2021, Lexaria announced that it had commenced the process for preparing an Investigational New Drug application for the purposes of filing same with the Food and Drug Administration with respect to registering its DehydraTECH-processed CBD as a pharmaceutical treatment for hypertension.

On October 5, 2021, Lexaria announced results from its oral nicotine absorption study NIC-A21-1 which revealed that DehydraTECH-nicotine delivered via the oral pouch product format required only 2 to 4 minutes to deliver nicotine levels in blood plasma comparable to levels achieved at 45 minutes with concentration-matched controls. DehydraTECH-nicotine also reached statistically significant peak blood plasma levels up to 10-fold higher overall than controls (p=0.004) while still clearing from blood virtually as quickly as the controls.

| Page 8 of 90 |

| Table of Contents |

On October 13, 2021, Lexaria announced the that its oral tetrahydrocannabinol (“THC”) absorption study THC-A21-1 revealed that DehydraTECH-THC delivered, via oral ingestion, required only 15 minutes to deliver THC levels in blood plasma comparable to levels achieved at 45 minutes with concentration-matched controls.

During the study DehydraTECH-THC delivered more THC into the bloodstream than the industry standard medium chain triglyceride (“MCT” or “coconut oil”) based control formulation from the 2-minute mark onwards, then dropped rapidly to the same level as the MCT control by the 6-hour mark.

On November 1, 2021, Lexaria commenced its first animal study EPIL-A21-1 to determine if DehydraTECH-CBD evidences superior treatment of seizure activity when compared to generic cannabidiol and Epidiolex and subsequently announced the following new research studies for the 2022 year:

| · | HYPER-H21-4: This 6-week efficacy study of approximately 60 volunteers who suffer from hypertension, will provide extensive data to Lexaria on how DehydraTECH-CBD treats hypertension and may provide additional long-term health benefits, including its effects on 24-hour ambulatory blood pressure; arterial stiffness and autonomic balance; brain structure and function through brain magnetic resonance imaging; blood biomarkers (including lipids such as cholesterol and more); renal, hepatic, sleep quality / daytime sleepiness / sleep disorders; actigraphy, geriatric depression scale, perceived stress, and Beck anxiety inventory. |

|

|

|

| · | HOR-A22-1: This PK study will evaluate the ability of DehydraTECH to enhance the delivery characteristics of estrogen. Estrogen helps to control the menstrual cycle but also controls cholesterol and protects bone health. |

|

|

|

| · | DEM-A22-1: This efficacy study will evaluate DehydraTECH-CBD with and without nicotine for the potential treatment of dementia. Alzheimer’s disease is the most common form of dementia and accounts for at least 60% of all cases, and nicotine is already showing promising results related to Alzheimer’s treatment. |

|

|

|

| · | RHEUM-A22-1: This efficacy study will focus on the ability of DehydraTECH-CBD to potentially affect treatment of rheumatoid disease. Given CBD’s postulated efficacy related to inflammation, Lexaria will explore a possible role for CBD in this area of investigation. Rheumatic diseases are autoimmune and inflammatory diseases that cause the immune system to attack joints, bones, muscles, and organs. |

Science and Technology

Lexaria is a drug delivery R&D company focused on developing and out licensing DehydraTECH for improved consumer experiences, rapidity, and delivery of bioactive compounds in oral and topical products. The Company is focusing its capital and management time on its pursuit of intellectual property, technology licensing opportunities, and an expanding portfolio of patent pending applications.

In 2014, the Company acquired the IP that formed our first patent application that was filed in the same year. From that first patent application, due to ongoing R&D investigation and work by Company management, we now have approximately 50 patent applications pending around the world, with 23 allowed/patents granted. All of our applications and allowed/granted patents relate to DehydraTECH and its enhancement of certain characteristics of oral ingredient and drug delivery. Additional early-stage investigation has been conducted of topically-administered products such as patches, creams and lotions.

| Page 9 of 90 |

| Table of Contents |

The Company developed a variety of demonstration products beginning in 2015 to demonstrate the potential uses for DehydraTECH to both consumers and potential licensees. These included teas, coffee, and protein energy bars – all utilizing DehydraTECH for the more palatable and efficient delivery of cannabinoids. The Company subsequently developed additional demonstration products including powder filled capsules and mix and serve powders for beverage incorporation also utilizing DehydraTECH for the more palatable and efficient delivery of bioactive molecules. The Company gained extensive experience and knowledge from the formulation and production of these demonstration products that facilitates assisting our licensees with the integration of DehydraTECH in their products.

In the production of our intermediate products for product manufacturers to use, each raw material, intermediate stage and completed product is assessed for compliance with all applicable regulations, and to ensure that the inputs and the finished products meet all applicable legal and quality standards including and as it relates to content; molds and mildews; heavy metals; and additional components.

The US Federal Government, through the US Department of Health and Human Services, owns US Patent #6630507, which among other things, claims that

“Cannabinoids have been found to have antioxidant properties, unrelated to NMDA receptor antagonism. This new found property makes cannabinoids useful in the treatment and prophylaxis of wide variety of oxidation associated diseases, such as ischemic, age-related, inflammatory and autoimmune diseases. The cannabinoids are found to have particular application as neuroprotectants, for example in limiting neurological damage following ischemic insults, such as stroke and trauma, or in the treatment of neurodegenerative diseases, such as Alzheimer's disease, Parkinson's disease and HIV dementia.”

For reference, cannabinoids are compounds that affect cannabinoid receptors located on many human cells. CB1 receptors are widely found within the human brain; and CB2 receptors are found with the human immune system and have been linked to anti-inflammatory and other responses.

Over one hundred different cannabinoids have been isolated from the cannabis plant, most of which do not have psychoactive properties. One that does have psychoactive properties is THC. Endocannabinoids are produced naturally in the human body while phyto cannabinoids are produced in several plant species, most abundantly in the cannabis plant.

Cannabidiol (“CBD”) is one of the major phyto cannabinoid and is not psychoactive, often comprising more than 35% of the extracts from the cannabis plant resin. CBD occurs naturally in other plant species beyond cannabis. For example, the most widely acknowledged alternative source of phyto cannabinoid is in the better understood Echinacea species, in widespread use as a dietary supplement. Most phyto cannabinoids are virtually insoluble in water but are soluble in lipids and alcohol. The World Anti Doping Agency (“WADA”) has exempted CBD from its 2018 list of banned substances.

In the U.S., the 2018 Farm Bill permits hemp cultivation and allows the transport of hemp-derived products across state lines, within a tightly regulated framework. Primary among these, the plant must contain less than 0.3% THC, and state departments of agriculture must submit their plans to license and regulate hemp to the Secretary of the USDA, or otherwise comply with a federally run hemp program. Legislative reform regarding CBD from hemp is continually evolving.

| Page 10 of 90 |

| Table of Contents |

Status of Operations

Most of Lexaria’s revenues are generated from third party businesses either licensing the intellectual property associated with DehydraTECH for incorporation into their products or purchasing DehydraTECH infused intermediate product as a raw material for use within their own products.

Intellectual Property

Since our first patent filing in 2014 for DehydraTECH, we have increased the number of patent applications to approximately 50 and to date have been allowed/granted 23 patents worldwide as of the date of this filing.

The substance of the patents center on the use of DehydraTECH in a variety of products including those that are ingested or topically administered such as CBD, food, beverage, patches, creams, lotions et cetera. Patents have been filed (and granted in both Australia and the EU) specifically for the use of DehydraTECH with cannabinoids for the treatment of heart disease. The pending and granted patents also cover the manufacturing and processing methods used to combine fatty acids with active pharmaceutical ingredients. This includes heating and drying methods and use of excipients and substrates. Below we summarize Lexaria’s allowed/granted patents.

Issued/Allowed Patent # | Patent Family |

US 9,474,725 B1 | Food and Beverage Compositions Infused with Lipophilic Active Agents and Methods of Use Thereof

|

US 9,839,612 B2 | |

US 9,972,680 B2 | |

US 9,974,739 B2 | |

US 10,084,044 B2 | |

US 10,103,225 B2 | |

US 10,381,440 | |

US 10,374,036 | |

US 10,756,180 | |

AU 2015274698 | |

AU 2017203054 | |

AU 2018202562 | |

AU 2018202583 | |

AU 2018202584 | |

AU 2018220067 | |

EP 3164141 | |

JP 6920197 | |

AU 2016367036 |

Methods for Formulating Orally Ingestible Compositions Comprising Lipophilic Active Agents |

JP 6963507 | |

MX 011399 | |

AU 2016367037 | Stable Ready-to-Drink Beverage Compositions Comprising Lipophilic Active Agents |

IN 365864 | |

JP 6917310 |

| Page 11 of 90 |

| Table of Contents |

On June 11, 2015, Lexaria initiated the simultaneous filing of a U.S. utility patent application and an international patent application under the Patent Cooperation Treaty (PCT) procedure, both through the U.S. Patent and Trademark Office (“USPTO”). These applications follow the Company’s 2014 and 2015 family of provisional patent application filings in the U.S. and serve two additional broad purposes:

| · | Lexaria is seeking protection of its intellectual property under international treaties. To this end Lexaria has filed for PCT patent application protection. There are 148 countries that are signatories to the Patent Cooperation Treaty, including such major markets as Canada, China, India, much of Europe and the Middle East, the United Kingdom and Japan among others. |

|

|

|

| · | Lexaria has demonstrated that its lipid infusion technology has applications beyond the delivery of just cannabinoids. Based on further formulation testing, Lexaria has included additional lipophilic molecules that may be delivered via oral administration utilizing its technology, widely encompassing three major market opportunities for the Company: Nicotine; NSAIDs; and Vitamins. |

In December 2015, the Company filed two further provisional patent applications in the U.S. These new applications served to further broaden the variety and applicability of base compounds that can be used when formulating DehydraTECH. The first of these applications identify compounds like edible starches (e.g., tapioca starch) that are commonly used in oral and pharmaceutical products today and could, therefore, serve as a base for formulating and incorporating DehydraTECH into a wide variety of products. The second of these applications identify emulsifier compounds like gum arabic that are commonly used in beverage products today in order to facilitate similar flexibility for formulating DehydraTECH in shelf-stable beverages.

On October 26, 2016, the USPTO issued U.S Patent No. 9474725, Food and Beverage Compositions Infused with Lipophilic Active Agents and Methods of Use Thereof, pertaining to our method of improving bioavailability and taste of certain cannabinoid lipophilic active agents in food products. This was the Company’s first patent granted and has a publish date of October 27, 2016 (June 15, 2017, in Australia No. 2015274698) and protects DehydraTECH for twenty years. Additional patent grants include, but are not limited to the use of DehydraTECH as a delivery platform, “composition of matter” claims that protect the specific combination of substances which enable improved taste and bio absorption properties, that protect processes for making specific compositions of matter for enhanced cannabinoid delivery utilizing DehydraTECH. Of note, Lexaria has received issuance of patents in its second and third patent families representing the first time the Company has been granted claims for use of DehydraTECH in connection with the treatment of specific diseases and medical conditions affecting humans, which the Company believes will prove to be of significance to the pharmaceutical industry sector as it further develops and grows.

International Patent Protection

Lexaria first began work in the fields of enhanced delivery of active ingredients and drugs in 2014 focusing our efforts on R&D within the U.S. and Canadian marketplaces with our demonstration products to licence DehydraTECH to product manufacturers. Our pursuit and development of our technology has expanded our potential area of impact, both geographically and by sector. Because of the applicability of DehydraTECH to many market sectors across the globe, we have taken the necessary steps to protect that intellectual property internationally.

Additional Molecules

Lexaria does not intend to create or produce consumer products ourselves, rather, our business plan is to encourage existing participants within these sectors to license and utilize DehydraTECH to enable enhanced performance of their products across a wide range of lipophilic bioactive molecules of interest to us including and beyond CBD. Some of these additional lipophilic bioactive molecules of interest are summarized below, and additional molecules of interest are continually being evaluated.

| Page 12 of 90 |

| Table of Contents |

Antivirals.

Viruses and bacteria cause the most common infectious diseases in the world today. Vaccines can offer protection against contracting viral and bacterial infections, whereas antiviral drugs and antibiotics respectively are required as treatments to combat disease if vaccination or other protective measures are inadequate or are not available. Early research findings have shown that some known antiviral drugs like remdesivir, interferon beta-1b, lopinavir, ritonavir and ribavirin among others, evaluated alone and in combination treatment regimens, may have utility against COVID-19 caused by infection with the novel coronavirus. Most of the antiviral drugs currently available are used to treat infections caused by HIV, herpes viruses, hepatitis B and C viruses, and influenza A and B viruses, and are therefore being repurposed to evaluate prospective utility against COVID-19. While a host of antiviral drugs exist or are under development today as treatments for COVID-19 and other infectious disease conditions, many of them are hindered by poor water solubility which, in turn, results in their poor absorption and uptake by the body if taken orally, frequently limiting their overall therapeutic effectiveness. To attempt to overcome this, oral antiviral medications often have to be given at high doses which can result in a variety of unwanted side effects including diarrhea, headache, nausea, vomiting, stomach upset, drowsiness, dizziness, vision changes, difficulty breathing and other bodily dysfunctions. Alternatively, in some cases it is necessary to administer antiviral medications by way of needle injection for easier access to the bloodstream circumventing the gastrointestinal absorption limitations as is the case with, for instance, remdesivir, as mentioned above. However, injectable administration requires involvement of a medical practitioner which may not be easily accessible for the masses, usually increases cost of a medicine and often means that the product format isn’t as stable or requires special storage and handling considerations relative to oral medications.

Nicotine.

More than 99% of all nicotine consumed worldwide is delivered through smoking cigarettes. Approximately 6,000,000 deaths per year, worldwide, are attributed primarily to the delivery of nicotine through the act of smoking according to the Centers for Disease Control and Prevention, which also estimates that over $170 billion per year is spent just in the U.S. on direct medical care costs for adult smokers. 69% of U.S. adult smokers want to quit smoking and 43% of U.S. adult smokers have attempted to quit in any twelve-month period.

Worldwide, legal retail cigarette sales were worth US$814 billion in 2018 with illegal sales thought to represent another 11.2% of the global market (bat.com) with over 5.3 trillion cigarettes sold to more than 1 billion smokers.

Non-steroidal anti-inflammatories.

NSAIDs are the second-largest category of pain management treatment options in the world and are used both for pain management and for treatment of inflammation. The anti-inflammatory therapeutic market is expected to generate $106.1 billion in 2020, globally (alliedmarketresearch.com). Incurable inflammatory autoimmune diseases included arthritis, asthma, and chronic obstructive pulmonary disease (COPD). The U.S. makes up over one-half of the global market. The opioids market (such as morphine) forms the largest single pain management sector but are known to be associated with serious dependence and tolerance issues.

Some of the most commonly known NSAIDs are ASA (Aspirin), Ibuprofen (Advil, Motrin), and Acetaminophen (Tylenol - Acetaminophen is not accepted by all persons to be an NSAID). Although NSAIDs are generally a safe and effective treatment method for pain, they have been associated with a number of gastrointestinal problems including dyspepsia and gastric bleeding and certain adverse effects on human kidneys.

On August 11, 2015, Lexaria signed a license agreement with PoViva Tea LLC for $10,000, granting Lexaria a 35-year non-exclusive worldwide license to unencumbered use of PoViva Tea LLC’s IP Rights, including rights of resale. This license agreement ensures Lexaria has full access to the underlying infusion technology. On January 14, 2019, this agreement was updated whereby PoViva Corp. (formerly PoViva Tea LLC) granted Lexaria an exclusive license to use DehydraTECH technology for a period of time ending 25 years after the date of the last patent granted to PoViva Corp.

| Page 13 of 90 |

| Table of Contents |

Scientific testing and validation

CBD and Other Cannabinoid Programs

Our experimentation with, and validation of DehydraTECH technology has been ongoing since 2015. On August 24, 2015, the Company announced achievements in enhanced gastro-intestinal absorption of CBD utilizing DehydraTECH. The third-party testing was conducted in two phases of in vitro tests beginning in June and completed in August 2015.

The independent laboratory results delivered average CBD permeability of 499% of baseline permeability, compared to CBD permeability without DehydraTECH, exceeding Company expectations. This was assessed in a strictly controlled, in vitro experiment using a human intestinal tissue model.

The tests also showed 325% of baseline gastro-intestinal permeability of CBD comparing Lexaria’s CBD-fortified ViPova black tea to a second control of CBD and black tea combined, without Lexaria’s patented formulation enhancements. This confirmed that the specialized processing undertaken by Lexaria during its manufacturing process together with its formulation enhancements, does indeed significantly improve absorption levels.

The bioavailability of CBD (or of THC) varies greatly by delivery method. Smoking typically delivers cannabinoids at an average bioavailability rate of 30% (Huestis (2007) Chem. Biodiverse. 4:1770–1804; McGilveray (2005) Pain Res. Manag. 10 Suppl. A:15A – 22A). By comparison, orally consumed cannabis edibles typically deliver cannabinoids at an average bioavailability rate of only 5% (Karschner et al. (2011) Clin. Chem. 57:66–75).

During January 2015, Lexaria conducted a study of nitric oxide levels in humans, as a biomarker for absorption of CBD, with the expectation that it would provide additional evidence of the efficient absorption of CBD from DehydraTECH -enhanced oral products enhanced with hemp oil, by demonstrating the elevation of nitric oxide in the human body in response to oral ingestion.

The study data from human subjects demonstrated significant elevation of systemic nitric oxide levels as a surrogate biomarker for CBD bio absorption in response to ingestion of Lexaria’s oral delivery. This provided clinical support for the CBD bioavailability enhancing properties of DehydraTECH, on the premise that bioavailable CBD is known to elevate levels of the endocannabinoid anandamide in the human body which, in turn, stimulates release of nitric oxide in the vascular system.

In August of 2018 we released the results from our randomized, placebo-controlled, double-blind European human clinical study that evaluated a DehydraTECH-CBD hemp oil capsule developed by Lexaria. The degree and speed of CBD absorption into blood plasma and potential cardiovascular and cognitive performance enhancement in 12 healthy male volunteers was studied.

Key metabolic and hemodynamic performance findings linked to bioavailability enhancements were revealed in the study as released in February 2019, which compared a 90 mg dose of Lexaria’s DehydraTECH enhanced TurboCBD capsules to a 90 mg dose without DehydraTECH (the “positive control”) as well as a placebo, as follows:

| · | Analysis of mean arterial blood pressure (MAP) at peak blood levels of CBD achieved with Lexaria’s TurboCBD demonstrated a significant reduction in MAP compared to placebo (95% CI; p=0.027). This finding was not observed with the dose-matched positive control formulation for which there was no significant decrease in MAP compared to placebo (95% CI; p=0.625); |

|

|

|

| · | Cerebral perfusion was also analysed by an index of conductance in the middle cerebral artery (MCA). The findings revealed that Lexaria’s TurboCBD caused the greatest increase in MCA conductance relative to both the positive control formulation and placebo (95% CI; p=0.017 and P=0.002 respectively); |

| Page 14 of 90 |

| Table of Contents |

Finally, over the six-hour study, analysis of the total area under the curve (AUC) demonstrated that Lexaria’s DehydraTECH enhanced TurboCBD capsules resulted in a notable trend for higher levels of CBD in the bloodstream overall than the positive control formulation with total AUC of 10,865 ± 6,322 observed with Lexaria’s formulation compared to 7,115 ± 2,978 observed with the positive control (95% CI; p=0.096).

These results corroborate and confirm other in vitro and in vivo studies that evaluated DehydraTECH. Although this study evaluated absorption only of CBD and its metabolites, Lexaria believes nearly identical bioavailability enhancement results would be achieved with other cannabinoids.

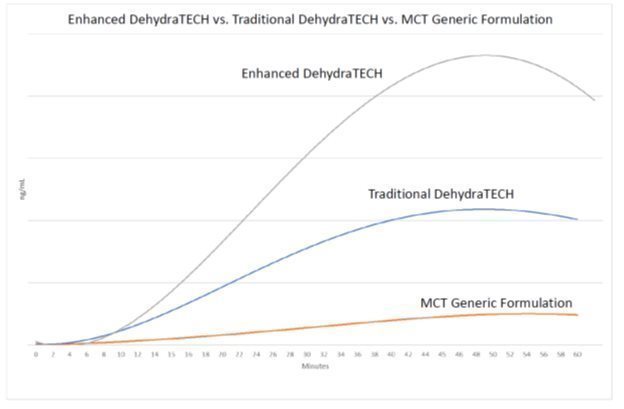

During March of 2019 we also launched an in vivo research program to test Lexaria-designed DehydraTECH enhancements (“Enhanced DehydraTECH”) comprised of eleven separate animal studies and released initial results during May 2019 demonstrating measurable quantities of cannabidiol into blood in as little as 2 minutes. In the first animal study results it announced, Lexaria compared its standard DehydraTECH formulation that combined cannabinoids with long-chain fatty acids (“LCFA”) using Lexaria’s patented dehydration processing technique to a concentration-matched formulation utilizing coconut oil which is a commonly used MCT oil in the cannabis edibles industry, with some key findings noted:

| · | At 2 minutes DehydraTECH’s LCFA formulation delivered measurable CBD in blood, compared to no measurable CBD in blood until 6 minutes and onwards for the MCT oil formulation. |

|

|

|

| · | At 60 minutes DehydraTECH’s LCFA formulation achieved a CBD blood concentration level of 319% more than the MCT oil formulation. |

|

|

|

| · | Over the entire 60-minute study, the area under the curve (AUC) (total quantity of CBD delivered) for the Lexaria DehydraTECH LCFA formulation was 389% more than the MCT oil formulation (p<0.0011). |

Lexaria also tested for brain tissue concentrations to quantify 8-hour CBD delivery from the DehydraTECH-enabled LCFA formulation compared to the MCT oil formulation and DehydraTECH’s LCFA formulation outperformed the MCT oil formulation by 246%.

The Company released additional results from its March 2019 research program wherein animal testing proved that Enhanced DehydraTECH delivered 1,137% more CBD into animal brain tissue following oral ingestion than certain existing industry formulations. Delivery of CBD into the brain was reported 8 hours after dosing, as follows:

| · | The Lexaria DehydraTECH LCFA formulation without nanotech achieved an average brain tissue accumulation level that was 246% higher than the average for those animals that received the MCT oil formulation (p=0.0013). |

|

|

|

| · | The Lexaria DehydraTECH LCFA formulation with nanotech achieved an average brain tissue accumulation level that was 1,137% higher than the average for those animals that received the MCT oil formulation (p=0.0178). |

Further results demonstrated that Enhanced DehydraTECH led to 811% more CBD delivery into blood than generic industry MCT coconut-oil formulations (p=0.00008); and 110% more CBD into blood than DehydraTECH in its traditional format (p=0.02).

| Page 15 of 90 |

| Table of Contents |

| · | Enhanced DehydraTECH delivered roughly twice as much CBD to animal blood at all measured time points in the study from the 15-minute mark onwards, compared to traditional DehydraTECH; and during the same time points from 717% to 1098% more CBD than the generic industry MCT coconut oil formulations. |

|

|

|

| · | Enhanced DehydraTECH delivered 1,937% more CBD into animal brain tissue after 8 hours compared to generic industry MCT coconut oil formulations; and 487% more than traditional DehydraTECH. Both traditional DehydraTECH and Enhanced DehydraTECH delivered maximum blood concentration levels prior to the 60-minute end-of-test, with levels tapering off thereafter. |

During 2021, we also commenced further DehydraTECH formulation enhancement and performance optimization work. In May of 2021, we announced findings from Study HYPER-A21-1 that included three new "DehydraTECH 2.0" CBD formulation variations. All three new DehydraTECH 2.0 formulations delivered improved performance when compared to both Lexaria's original DehydraTECH and Enhanced-DehydraTECH concentration-matched formulations, as well as to a MCT oil-based control formulation representative of standard industry practices. These three DehydraTECH 2.0 formulations delivered between 1,068% and 2,178% more CBD during the study period than the standard MCT control formulation, and they also were up to 123% more effective than Lexaria’s original Enhanced DehydraTECH formulation. The three new DehydraTECH 2.0 formulations also delivered between 907%-1,737% more CBD into brain tissue than the MCT oil-based control formulation, similar to the up to 1,937% increase over the MCT oil based control formulation determined previously for Lexaria's original Enhanced DehydraTECH formulations.

Also during 2021, further DehydraTECH 2.0 formulation work was reported later in May from Study HYPER-A21-2. One of the DehydraTECH 2.0 formulations tested in this study produced the strongest absorption enhancement results Lexaria has ever recorded, at 2,708% more CBD into bloodstream during the study period than the representative industry standard MCT control formulation.

| Page 16 of 90 |

| Table of Contents |

Based on our many successes in enhancing CBD absorption in animals, and pursuant to our initial success in reducing blood pressure in our 2018 clinical study, Lexaria progressed to more advanced clinical studies later in 2021.

In July of 2021, we reported findings from Study HYPER-H21-1, in which human blood pressure was reduced across both male and female volunteers and was most pronounced with DehydraTECH-CBD in the first 10-50 minutes of the study. Blood pressure reduction from baseline was greatest when measured via systolic pressure. In a subset of volunteers who were Stage 2 hypertensive, peak systolic blood pressure reductions from baseline were observed of as much as approximately 13 mmHg by the 50-minute time point with DehydraTECH-CBD, and systolic BP remained depressed throughout almost the entire 3-hour duration of the study. There was also a tendency for a greater reduction in relative diastolic pressure from baseline with DehydraTECH-CBD than the concentration matched, generic CBD control tested in this study. This was most notable in the initial 10 to20 minute period post-dosing evidencing statistical significance at the 20-minute timepoint (p=0.025). As well, there was a tendency for relative Mean Arterial Pressure ("MAP") to be reduced greater from baseline with the DehydraTECH-CBD than the concentration matched, generic CBD control; again, most notably in the initial 20 minutes post-dosing. By comparison, in Lexaria's 2018 human clinical study, 120 minutes were required to achieve the same level of MAP reduction, demonstrating superior rapidity of onset of the CBD formulation used in Study HYPER-H21-1 relatively speaking. Lexaria was also pleased that its DehydraTECH-CBD was well tolerated by all subjects, with no serious adverse events or side effects observed or reported.

In September of 2021, we reported findings from Study HYPER-H21-2, in which human blood pressure was significantly reduced using DehydraTECH-CBD through the course of a 24 ambulatory study design. At selected times during the 24-hour study, volunteers with mild to moderate hypertension averaged as much as a 20 mmHg (i.e., 23%) decrease in BP relative to placebo. Over the 24-hour ambulatory monitoring period, volunteers averaged a significant reduction of 7.0% (p < 0.001) in systolic pressure, a significant reduction of 5.3% (p < 0.001) in MAP and a significant reduction of 3.5% in diastolic pressure relative to an increase in diastolic pressure (-0.8 vs. +2.7; p<0.001) from baseline with DehydraTECH-CBD relative to placebo. Also, of note, DehydraTECH-CBD triggered its most significant effects upon blood pressure attenuation through the overnight period while subjects slept and in the early morning period. This observation could have tremendous value therapeutically as these periods of the day are most often associated with cardiac stress and infarct events in hypertensive patients when people rise suddenly from and/or become increasingly active relative to the supine/sleeping state.

At the time of this filing, Lexaria has reported that it is pursuing two additional clinical studies that will also investigate the safety and effectiveness of DehydraTECH-CBD for hypertension (i.e., Studies HYPER-H21-3 and HYPER-H21-4). In addition, Lexaria has reported that it has also formally begun the process toward preparation and filing of an Investigational New Drug (“IND”) application with the Food and Drug Administration (“FDA”) with its DehydraTECH-CBD as a prospective registered pharmaceutical treatment for hypertension.

Beyond Lexaria’s hypertension pursuits with DehydraTECH-CBD, it also announced in November of 2021 that it has commenced important new investigational work (Study EPIL-A21-1) exploring whether DehydraTECH-CBD evidences superior ability to inhibit seizure activity compared to both generic CBD and the world’s only licenced pharmaceutical CBD formulation for treating seizure disorders, Epidiolex. And, looking forward to 2022, Lexaria has also announced that it is expecting to conduct additional animal studies to evaluate the potential benefits of DehydraTECH-CBD for other disease conditions of interest, including dementia via Study DEM-A22-1, rheumatoid conditions via Study RHEUM-A22-1 and diabetes via Study DIAB-A22-1.

| Page 17 of 90 |

| Table of Contents |

We have also completed our first study evaluating DehydraTECH used in a topical cream formulation for absorption of CBD through human skin. Results proved significant increases in both speed and quantity of CBD absorption through skin when compared to control formulations. The absorption study was performed on human skin at a California-based laboratory that specializes in Franz diffusion cell skin permeability testing. DehydraTECH was used together with a sophisticated oil-in-water emulsion formulation design and compared to a series of matching oil-in-water emulsion formulations prepared with the same CBD inputs, with and without DehydraTECH and with and without two leading skin penetration enhancers currently used in the skin products industry. Several factors were measured, including the time required to detect CBD skin penetration and quantity, and peak amounts of CBD absorbed into and through the skin, at multiple testing intervals over a 48-hour duration.

Lexaria’s DehydraTECH-enabled topical formulation, absent either of the commercial penetration enhancers, was the fastest acting for absorption into the epidermis, dermis or through the skin into the systemic fraction representing permeation into the underlying circulatory system.

Furthermore, Lexaria’s DehydraTECH-enabled topical formulation without the addition of either of the commercial penetration enhancers, demonstrated the highest overall average quantity of CBD delivered through the skin and into the representative systemic fraction of all the formulations tested, with as much as a 225% increase in CBD permeability when compared to the highest performing commercial penetration enhancer formulation assessed and almost a 1,900% increase in CBD permeability when compared to a control formulation that was devoid of both DehydraTECH or any commercial penetration enhancers. The commercial skin penetration enhancers only demonstrated performance that was on par or superior to the DehydraTECH-enabled formulations tested in so far as total CBD absorption into the shallow epidermis or dermis was concerned.

Finally, beyond CBD, we also conducted investigative work with another cannabinoid compound, THC, during 2021. In Study THC-A21-1, we demonstrated that DehydraTECH-THC delivered via oral ingestion required only 15 minutes to deliver THC levels in blood plasma comparable to levels achieved at 45 minutes with concentration-matched controls. During the study DehydraTECH-THC delivered more THC into bloodstream than the industry standard MCT based control formulation from the 2-minute mark onwards, then dropped rapidly to the same level as the MCT control by the 6-hour mark. These data may be of significance to prospective pharmaceutical applications for DehydraTECH-THC based therapeutics, pending further pursuit in this area.

Nicotine Programs

We have also completed ingestible nicotine in vivo (animal) absorption study work. In a study reported in April of 2018, DehydraTECH delivered the following major nicotine absorption performance improvements: 1,160% faster delivery of equivalent peak quantities of nicotine to the bloodstream than achieved with controls (within 15 min vs. 2.9 hours), 148% gain in the quantity of peak nicotine delivery to the bloodstream relative to controls, 560% higher brain levels of nicotine where nicotine effects are focused, compared to controls, lower urine levels of nicotine excreted than controls, for enhanced nicotine activity and bioavailability over the course of the study, lower quantities of key liver metabolites in the bloodstream than controls as hypothesized, suggesting bypass of first pass liver metabolism.

The study was designed to principally assess the relative ingestible nicotine absorption performance of DehydraTECH -powered formulations compared to concentration-matched control formulations that lacked any form of delivery enabling technology in rats.

The DehydraTECH formulations generally achieved faster absorption, higher peak absorption, and higher overall quantities of nicotine, on average, in the blood than the concentration-matched control formulations at both the 1mg and 10 mg/Kg doses tested. Furthermore, as previously reported, there were no obvious signs of gastrointestinal distress such as vomiting or diarrhea indicating that the animals appeared to tolerate the treatment well.

| Page 18 of 90 |

| Table of Contents |

Nicotine blood levels were evaluated multiple times over a period of 8 hours after dosing. In the 10mg/Kg dosing arm, the control formulation required nearly 3 hours to reach similar levels of blood absorption that the DehydraTECH formulation reached in only 15 minutes. Furthermore, the DehydraTECH formulation went on thereafter to demonstrate peak plasma levels that were 148% of those achieved by the control formulation. If replicated in human studies, these findings are suggestive that DehydraTECH could prove more effective in elevating blood nicotine levels through edible formats much more quickly and substantially than previously theorized, potentially making ingestible nicotine preparations a viable alternative to today’s available product formats while also leading to a more rapid nicotine craving satiation.

Analysis of the liver metabolites revealed, as expected, that overall levels in the blood of two of the three metabolites studied were higher in the control group than in the DehydraTECH formulation group at the 10 mg/Kg dose. The study also revealed that the DehydraTECH formulation at the 10 mg/Kg level achieved up to 5.6-times as much nicotine upon analysis of the rat brain tissue than was recovered with the matching control formulation. These findings together perhaps suggest prolongation of nicotine effectiveness with the DehydraTECH formulation which may also be beneficial in humans to control cravings over an extended time-period from a single edible nicotine dose.

Following the above study, additional study work was reported in August of 2018 by way of a follow-up third-party in vivo statistically significant study, including two groups of 20 animals. This study further demonstrated delivery of nicotine in edible form at each of the 2, 4, 6, 8 and 10-minute intervals post-dosing, with 90.2% greater delivery than the concentration-matched control formulation by the 10-minute mark (95% CI; p=0.044), and significantly greater absorption levels than the control formulation at all subsequent time points in the study. Speed of onset is a key attribute for oral drug administration, and it is of particular importance for the consideration of non-inhalation nicotine delivery formats.

Key highlights of the follow-up study were as follows:

| · | Peak Level: 79% improvement in peak blood levels (maximum concentration or “Cmax”) at 394 ng/mL using Lexaria’s DehydraTECH technology vs. 220 ng/mL with the control (95% CI; p=0.0257); |

|

|

|

| · | Total Quantity: 94% improvement in total quantity of nicotine delivered (area under the curve or “AUC”) to the blood during the 60-minute course of the study, at 266 hr•ng/mL versus 137 hr•ng/mL (95% CI; p=0.0086); |

|

|

|

| · | Rapidity: Lexaria’s technology delivered nicotine into the blood stream by the first time interval of blood sampling at the 2-minute mark. On average, Lexaria’s technology delivered 203 ng/mL to the blood in aggregate of the 2, 4, 6, 8, 10, 12 and 15-minute time points, compared to only 120 ng/mL in aggregate over the same period by the control, an improvement of 70% (95% CI; p=0.0004). |

Thereafter, during 2021, we also pursued study work in animals to investigate the pharmacokinetic performance of certain DehydraTECH 2.0 nicotine formulations specifically via the oral buccal/sublingual route of administration instead of the oral ingestible route of administration investigated previously. In October of 2021, we reported upon Study NIC-A21-1 conducted in male beagle dogs, which demonstrated that DehydraTECH nicotine delivered via the oral pouch product format required only 2 to 4 minutes to deliver nicotine levels in blood plasma comparable to levels achieved at 45 minutes with concentration-matched controls. DehydraTECH-nicotine also reached statistically significant peak blood plasma levels up to 10-fold higher overall than controls (p=0.004) while still clearing from blood virtually as quickly as the controls. Two nicotine formats were investigated in Study NIC-A21-1, namely nicotine benzoate and nicotine polacrilex. In the study, the generic nicotine benzoate pouch required approximately 45 minutes to reach its peak delivery rate whereas the DehydraTECH nicotine benzoate pouch reached peak delivery rates at both 8 minutes and again at 30 minutes. In fact, just 4 minutes after the pouch was placed in the mouth, the DehydraTECH-nicotine had reached a higher delivery level than the generic achieved at any point during the study. Similarly, the generic nicotine polacrilex pouch also required approximately 45 minutes to reach its very subdued peak delivery rate while the DehydraTECH nicotine polacrilex pouch achieved a comparable level in just 2 minutes. The DehydraTECH nicotine polacrilex pouch delivered over 10 times the nicotine level in blood plasma at peak than the generic version.

| Page 19 of 90 |

| Table of Contents |

Antiviral Drug Programs

During March of 2020, we also announced that we were commencing a program to study the prospective benefits of Lexaria’s DehydraTECH drug delivery platform for enhancing delivery and effectiveness of certain antiviral drugs in the fight against coronavirus disease COVID-19. We commenced this work initially reporting upon improved delivery in an animal study conducted with the antiviral drugs darunavir and efavirenz, with which we reported significant enhancements in drug delivery announced in December of 2020 in Study VIRAL-A20-1. Thereafter, we progressed to further study work with other drugs with antiviral properties including remdesivir and ebastine, where we demonstrated improved drug delivery in animal testing in Study VIRAL-A20-2, as well as effective inhibition of the SARS-CoV-2 virus that is responsible for COVID-19 in in vitro testing via Study VIRAL-C21-3 reported in June of 2021. Finally, we also reported significant improvements in drug delivery in animal using another compound with antiviral properties, colchicine, in Study VIRAL-A20-3, announced in July of 2021.

Technology out-licensing

Pursuant to the disposition of assets of CanPharm, all of the Company’s licenses associated with THC molecules for non-pharmaceutical purposes were assigned to Hill Street. As part of an asset purchase agreement entered into between CanPharm and Hill Street, on November 18, 2020, Lexaria Hemp Corp. (“Hempco”) entered into a 10-year license agreement with Hill Street to license DehydraTECH with respect to multiple products infused with CBD, replacing all previous agreements between the parties.

On January 15, 2019, the Company announced that its wholly owned subsidiary Lexaria Nicotine granted a license to use the DehydraTECH for oral nicotine delivery forms on an exclusive basis in the United States and a non-exclusive global basis to Altria Ventures Inc., an indirect wholly owned subsidiary of Altria Group, Inc. (“Altria”). During fiscal 2021, Altria relinquished their exclusive rights and retain non-exclusive rights within the U.S.

On July 11, 2019, the Company announced that it entered a definitive 5-year agreement, via its subsidiary Hempco, to license DehydraTECH to Universal Hemp LLC, for the production of infused powder substrates for inclusion in finished goods. This license was subsequently terminated on August 30, 2021.

On December 27, 2019, the Company, via Hempco entered into a 10-year US exclusive license agreement with Boldt Runners Corporation (“Boldt Runners”) for the use of DehydraTECH in connection with manufacturing CBD infused oral pouch products. Subsequent to the year ended August 31, 2021, Boldt Runners relinquished their exclusive rights and maintain non-exclusive rights.

Subsequent to the year end, on September 16, 2021, Hempco entered into a 10-year license with GlobalCanna Inc. for the use of DehydraTECH in multiple CBD infused products in the country of Canada.

| Page 20 of 90 |

| Table of Contents |

The continuation of our business interests in these sectors is dependent upon obtaining further financing, a successful program of development, and, ultimately, achieving a profitable level of operations. The issuance of additional equity securities by us could result in a significant dilution in the equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.

We are not yet profitable and have not yet demonstrated our ability to generate significant revenues from our business plan. We will require additional corporate funds if our existing capital is not sufficient to support the Company until potential future profitability is reached. There are no assurances that we will be able to obtain further funds required for our long-term operations. We expect to require additional operating capital during our fiscal 2021 year. There can be no assurance that additional financing will be available to us when needed or, if available, that it can be obtained on commercially reasonable terms. If we are not able to obtain the additional financing on a timely basis, we will be unable to conduct our operations as planned, and we will not be able to meet our other longer-term obligations as they become due. In such event, we could be forced to scale down or perhaps even cease our operations. There is uncertainty as to whether we can obtain additional long-term financing if we do in fact require it.

We hired two additional staff members during fiscal 2021 to enhance operations in our office and licenced laboratory space. We currently have eight staff members and do not anticipate hiring large numbers of new staff members during fiscal 2022. We expect to be able to utilize contracted third parties for our R&D testing programs, instead focusing our capital on higher value-added aspects of our research and development, and scientific test planning.

Our Company relies on the business experience of our existing management, on the technical abilities of consulting experts, and on the technical and operational abilities of its operating partner companies to evaluate business opportunities.

Competition

The biopharmaceutical industry is characterized by intense competition and rapid innovation. Our competitors may be able to develop other drug delivery platforms that are able to achieve similar or better results than DehydraTECH. Our potential competitors include major multinational pharmaceutical companies, established biotechnology companies, specialty pharmaceutical companies, universities, and other research institutions. Many of our competitors have substantially greater financial, technical, and other resources, such as larger research and development staff and experienced marketing and manufacturing organizations and well-established sales forces. Smaller or early-stage companies may also prove to be significant competitors, particularly as they develop novel approaches to oral or topical drug delivery that our DehydraTECH is also focused on. Established pharmaceutical companies may also invest heavily to accelerate discovery and development of novel therapeutics or to in-license novel therapeutics that could make the product candidates that are can be delivered using DehydraTECH obsolete. Mergers and acquisitions in the biotechnology and pharmaceutical industries may result in even more resources being concentrated in our competitors. Competition may increase further as a result of advances in the commercial applicability of technologies and greater availability of capital for investment in these industries. Our competitors, either alone or with collaborative partners, may succeed in developing, acquiring, or licensing API delivery technologies that are more effective, safer, more easily commercialized or less costly than our DehydraTECH proprietary technology or secure patent protection that we may need for the enhancement of our DehydraTECH. We believe the key competitive factors that will affect the development and commercial success of any DehydraTECH enhanced product candidates are efficacy, safety, tolerability, reliability, convenience of use, price, and reimbursement. We face competition from segments of the pharmaceutical, biotechnology and other related markets that pursue the development of API delivery platforms which may be more effective or cost efficient than our DehydraTECH. We anticipate that we will continue to face intense and increasing competition as new advanced API delivery technologies become available. There can be no assurance that our competitors are not currently developing, or will not in the future develop, technology that is equally or more effective or is more economically attractive than any of our current or any enhanced versions of DehydraTECH.

| Page 21 of 90 |

| Table of Contents |

Competition in alternative health sectors and in consumer products in the U.S. is fierce. We expect to encounter competitive threats from existing participants in the sector and new entrants with competing technologies. Although PoViva Corp. has filed patent applications to protect intellectual property, there is no assurance that patents beyond those already issued will be granted nor that other firms may not file superior patents pending. Food supplements, organic foods, and health food markets are all well established and the Company and/or its licensees will face many challenges within these markets. Lexaria is also aware of various competing technologies that exist in the marketplace that claim to also enhance the bio absorption of bioactive molecules as Lexaria has demonstrated through repeated in vitro and in vivo scientific testing with DehydraTECH. By and large, these technologies are mostly forms of nanotechnology that generally claim to enable the formation of microencapsulated microemulsions of active ingredients. These technologies can enable exceptional water solubility of ingredients and can impart improved intestinal bio absorption as a result, but do not necessarily offer the breadth of performance and value enhancing benefits that Lexaria’s DehydraTECH technology offers to its licensees.

Competition in nicotine, alternative nicotine delivery and nicotine cessation sectors in the U.S. is comprised of long-established entities, brands, and new technologies competing to create less harmful options. The sectors are complicated by the significant historical empirical data of older products or technologies versus the more limited published supporting data regarding the effects of new products or technologies. Due to the size of the sectors we expect to encounter competitive threats from existing participants and unknown new entrants. There is no assurance that other technologies already deployed, or in development, will not form the basis of product formats that competitors or consumers choose to utilize. It is also possible that historic delivery methods that have been in use and the familiarity with them may prevent adoption of products utilizing DehydraTECH in alternative delivery formats. Competing technologies or products may utilize known delivery formats or entirely new and unforecastable formats. Lexaria has demonstrated through scientific testing that DehydraTECH delivers nicotine rapidly and effectively through oral delivery. We believe that if we can educate and influence consumers to adopt a food-grade edible product format, and if US regulatory bodies authorize such formats, we may be able to offer a competitively successful new product format that utilize DehydraTECH.